Is loan payable an expense?

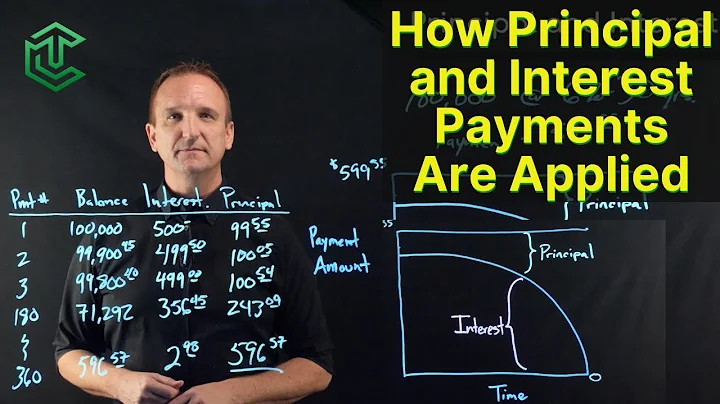

Is a Loan Payment an Expense? A loan payment often consists of an interest payment and a payment to reduce the loan's principal balance. The interest portion is recorded as an expense, while the principal portion is a reduction of a liability such as Loan Payable or Notes Payable.

Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses. Liabilities can be contrasted with assets. Liabilities refer to things that you owe or have borrowed; assets are things that you own or are owed.

Loans Payable

This is a liability account. A company may owe money to the bank, or even another business at any time during the company's history.

A loan payable is a liability on a company's balance sheet that represents the amounts the company owes to lenders as a result of borrowing money. The loan is categorized as a payable because it represents an obligation that the company has to pay in the future.

Ans: No, as loans are not income, you do not have to pay taxes on the availed business loan amount. However, if the lender forgives the loan, you are liable to pay taxes on the amount.

Example of Loan Payment

Let's assume that a company has a loan payment of $2,000 consisting of an interest payment of $500 and a principal payment of $1,500. The company's entry to record the loan payment will be: Debit of $500 to Interest Expense. Debit of $1,500 to Loans Payable.

Accounts Payable

This thirty day period of credit is in essence a short-term loan, which is why payables are recorded under the current liabilities section of the balance sheet.

Hi Christina - Loan payable, is a loan you have received from someone and so is "payable" by you, whereas Loan receivable is a loan you have made to someone else and so is "receivable" by you.

No, the principal payment of a loan is not included in the income statement. The repayment of the principal amount only affects the balance sheet.

To record a loan from the officer or owner of the company, you must set up a liability account for the loan and create a journal entry to record the loan, and then record all payments for the loan.

Is loans payable debit or credit?

Pay loan money back: The loans payable account is debited and the cash account is credited. Supplies purchased from a supplier using credit: The supplies expense account is debited and the accounts payable account is credited.

Accounts payable involves recording and processing supplier invoices with trade credit terms and paying the suppliers of goods and services, whereas notes payable are written contracts that typically serve the purpose of obtaining financing and paying debts through financial institutions and credit companies.

Is accounts payable an expense? No. The main difference between accounts payable and expenses is how they are recorded on a company's financial statements. Accounts payable appear on the balance sheet, while expenses are recorded on the income statement.

Recurring expenses are costs that occur on a regular basis. Examples of recurring expenses include rent or mortgage payments, office supplies, utilities, and insurance. You can deduct these expenses from your income on your taxes. In general, rent or mortgage payments come under the category of operating expenses.

Journal entry for a loan received from a bank

When a business receives a loan from a bank, the Cash asset account is debited for the amount received, and the Bank Loan Payable liability account is credited for the amount received that must be paid back to the bank at some point in the future.

Interest on loan is an indirect expense and should be debited to the profit & loss account.

- Go to Settings ⚙ then Chart of accounts (Take me there).

- Select New.

- Select either Other Current Liabilities or Long-term Liabilities.

- Name the account.

- Leave the Unpaid Balance blank, then select Save.

- Click the + New button.

- Select Journal entry.

- On the first line, select the liability account for the loan from the Category dropdown. ...

- On the second line, select the expense account for the interest from the Category dropdown. ...

- On additional lines, add any additional fees.

Your debt repayment is not an expense, it's an internal transfer. The only part that's an expense is the interest. The rest of the money was spent some time in the past, when you incurred the debt. The same principle applies when you put money into your savings account.

- Select + New.

- Select Journal entry.

- On the first line, select the liability account you just created from the Account dropdown. ...

- On the second line, select your bank account from the Account dropdown. ...

- When you're done, select Save and close.

How do you treat a loan on a balance sheet?

The full amount of your loan should be recorded as a liability on your business's balance sheet. Two liability accounts should be set up: one for short-term and one for long-term. The offset is either an increase to cash or the recording of new assets like a car, truck, or building.

Definition of Loan Principal Payment

The principal amount received from the bank is not part of a company's revenues and therefore will not be reported on the company's income statement. Similarly, any repayment of the principal amount will not be an expense and therefore will not be reported on the income statement.

Loans are generally never recorded as revenue. A loan is recorded as a liability that will need to be repaid.

What are the Golden Rules of Accounting? 1) Debit what comes in - credit what goes out. 2) Credit the giver and Debit the Receiver. 3) Credit all income and debit all expenses.

Accrued expenses and accounts payable are two methods companies use to track accumulated expenses under accrual accounting. Accrued expenses are liabilities that build up over time and are due to be paid. Accounts payable are liabilities that will be paid in the near future.